What is Risk?

The Oxford Dictionary defines risk as ‘the possibility that something unpleasant or unwelcome will happen,’ and this is the meaning that most people relate with. Risk is the failure of a projected narrative, derived from realistic expectations, to unfold as envisaged.

Risk is asymmetric. We do not hear people say ‘there is a risk that I might win the lottery’ because winning the lottery is not something they would describe as a risk. They do not even say ‘there is a risk I might not win the lottery’ because they do not realistically expect to win the lottery. The everyday meaning of risk refers to an adverse event which jeopardises the realistic expectations of the individual household or institution.1

What is Uncertainty?

The Oxford Dictionary defines uncertainty as ‘the state of being uncertain,’ and the meaning of uncertain as ‘not able to be relied on, not known or definite.’

Imperfect Knowledge —> Creates a State of Doubt —> Leads to Uncertainty

For uncertainty to manifest itself, it must be accompanied by a state of doubt. E.g., Donald Trump or many politicians of his cult are ignorant and have incomplete knowledge, but they are not doubtful of their knowledge, and therefore experience no uncertainty.

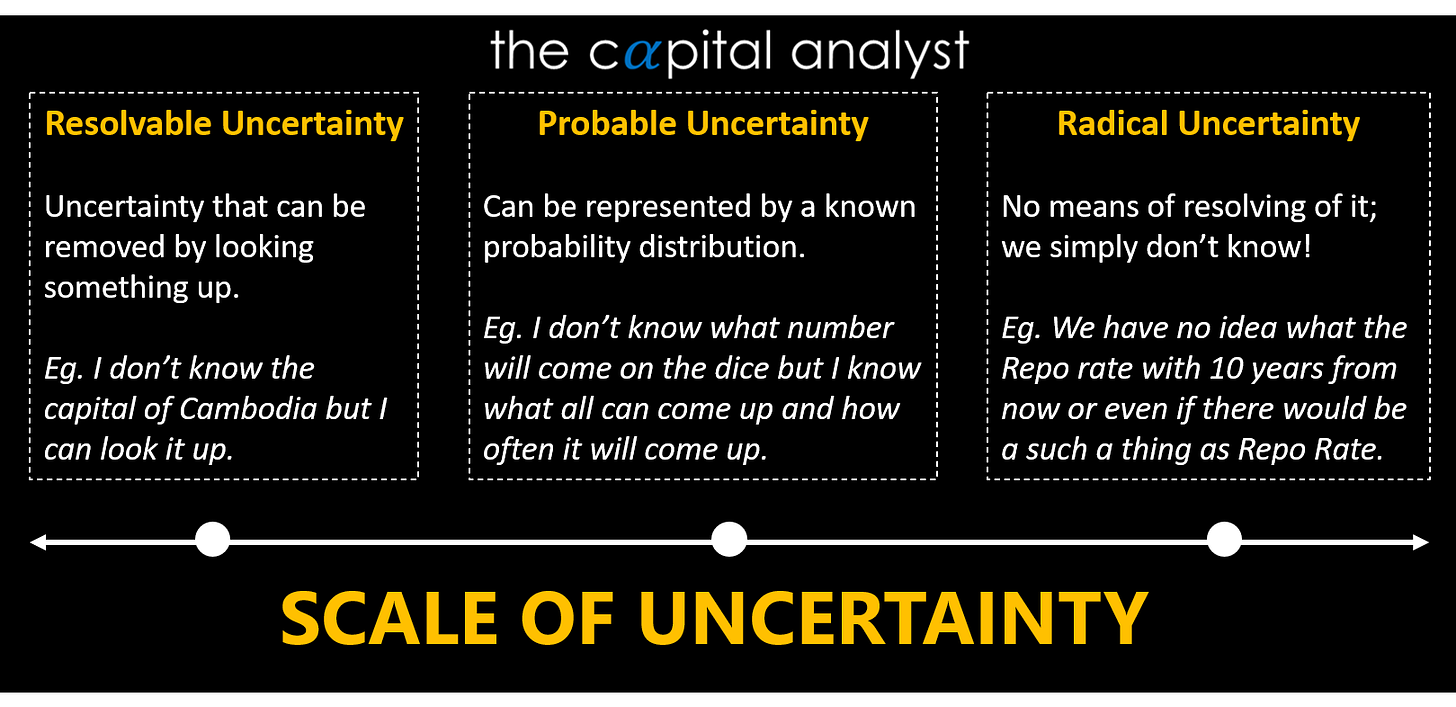

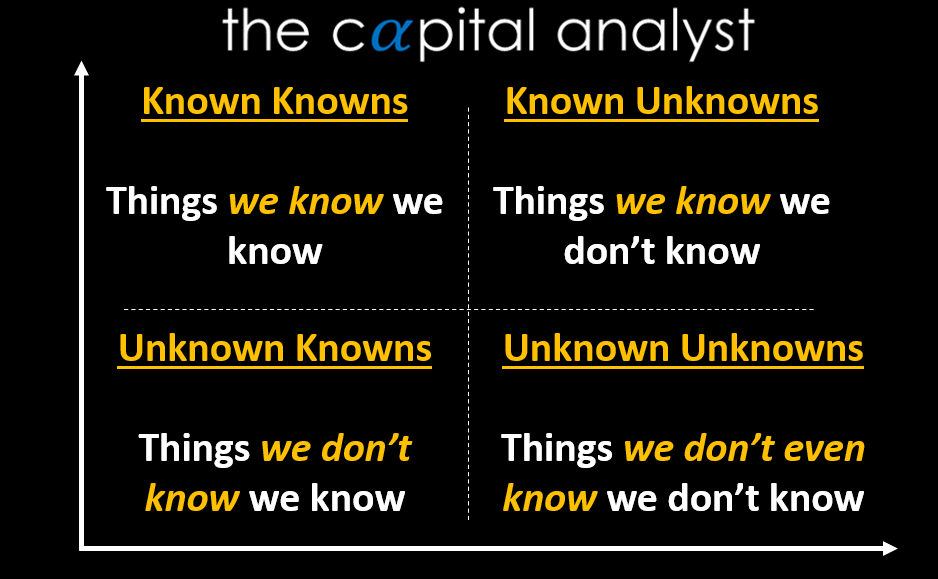

Uncertainty = Unknown Unknowns

When we describe radical uncertainty, we are not talking about ’long tails’ – imaginable and well-defined events whose low probability can be estimated, such as a long losing streak at roulette. What we are actually talking about is uncertainty as ‘unknown unknowns’.

This is similar to what Taleb calls “Black Swans”. The origin of the metaphor is that Europeans believed all swans to be white – as all European swans are – until the colonists of Australia observed black swans. True ‘black swans’ are states of the world to which we cannot attach probabilities because we cannot conceive of these states.

What is Probability?

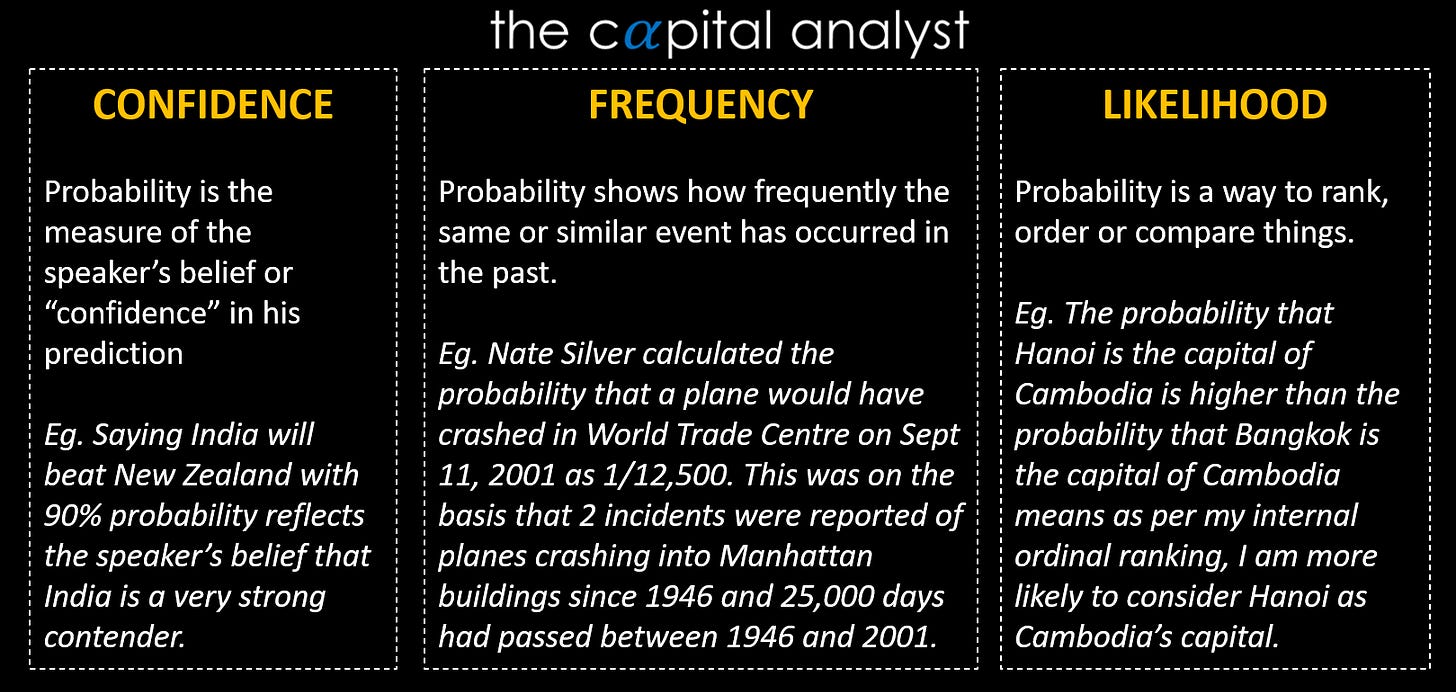

Let’s say we have a statement: The probability India will win against New Zealand in this T20 match is 90%. Strictly speaking, this translates to the fact that given 100 similar occasions where both these teams play with the same line-up at the same venue, India will be expected to win approximately 90 matches. And it’s no mystery that this interpretation serves no useful purpose for a spectator or bettor in that particular match.

There is no such thing as Probability; there’s only confidence, frequency, and likelihood!

Risk & Narratives

Risk is best explained through a reference narrative, a story that is an expression of our realistic expectations. Let’s understand this from the lens of President Obama taking the call to order a raid on Osama bin Laden’s hiding place.

A reference narrative governed the meeting at which President Obama ordered the SEALs to Abbottabad. The helicopters would land in the compound, the men would fight their way into the building. We suppose, but do not know, that the unspoken premise was that bin Laden would be killed in the attack. Dead or alive, he would be flown out of Pakistan in US custody. That reference narrative describes, more or less, what actually happened.2

But a lot of things could have changed that narrative. There might have been operational issues like equipment failure. Laden might not have been present in the compound, or it might have been a double. Pakistan army might have got winds of the operation and decided to stage an armed response. Should the USA have retaliated in such a hostile scenario? Should they try to keep Pakistan informed in advance of their plans?

Thus, we see that the overriding objective was to ensure that the reference narrative was robust and resilient. The key to managing risk is the identification of reference narratives that have these properties of robustness and resilience.

The World is NOT Stationary

Defining risk as volatility has been popular among economists. It fits well with the notion that the difference between expected utility and expected wealth is a quantitative measure of risk aversion.

Risk as volatility can be compounded with risk aversion to yield a monetary value of the cost of risk. This calculation enables risk to be priced as a commodity and bought and sold between people who have different preferences for risk, just as fruit can be bought and sold among people who have different preferences for apples and pears.3

This difference between the notions of expected wealth and expected utility explains why a rich man is more likely to invest in a gamble or speculative trade than a poor man. That’s the same reason why we decide to buy insurance.

The expected disutility – the financial and emotional loss you will suffer from (burning of your house), multiplied by its admittedly low probability – is larger than the cost of the (insurance) premium. So, the expected utility of the transaction is positive even if its expected value is negative. Conversely, the expected value to the insurer is positive and by pooling risks…. the company achieves a high probability of making a profit overall.4

Absence of Volatility ≠ Absence of Risk

This erroneous conclusion is based on the problem of induction. We can’t conclude that the sun will rise tomorrow based on the information that it has always risen in the past. We need an understanding of unchanging scientific facts to make this inference, and just the fact that the sun has been rising every day (=absence of volatility) is not substantial grounds to extrapolate this behavior in the future. The mistaken belief that the absence of current volatility demonstrates the absence of risk was at the heart of the 2008 financial crisis.

Evolution & Risk Go Hand-in-Hand

Humans are social creatures and have evolved together in groups. And evolution favors survival over all else. Thus, combining the two statements, we can argue that humans are expected to display those risk-taking abilities that are most conducive to survival and hence evolution. And that risk-taking ability is likely to be opposed to maximizing expected value.

For an individual, choosing the strategy most likely to succeed maximizes expected winnings. But a group made up of such optimizing individuals is eventually wiped out by infrequent calamities. Since humans operate in groups, success within and relative to other groups will influence the outcome of the biological process of gene replication. As a result, the groups whose genes come to dominate are those who apply ‘mixed strategies’, varying their habitat.5

Evolution is key, not just to explain the origin of species but to understanding the development of our economy and society.

Embracing Uncertainty means Challenging Narratives

Constantly asking “What’s going on here” and going back to the drawing board to stress test all narratives is the only way to “avoid risk and embrace uncertainty”.

It is important to understand that models are only “small worlds”; an inexact replication of the real world helps us focus our attention on one little problem by keeping almost everything else constant. They should never be mistaken for reality because a model that can replicate reality will become reality itself.

Thus, the role of the economist and other social scientists becomes one of framing problems under radical uncertainty rather than directly coming up with solutions. And framing problems begins by asking, “What’s going on here?” and challenging the current dominant narrative.

Podcast: Advertising, Writing, & Freelancing

with Sanjana Ramachandran

Sanjana is an independent author and marketing consultant. Her articles on business, tech, and culture have appeared in leading publications, including The Caravan, ThePrint, Fifty Two.In, Rest of World, The Ken, and Raiot magazine. My personal favorite is her article, “The Namesakes”. Do check it out!

Listen to the entire conversation on YouTube, Spotify, or Apple Podcasts.

5 Writing Recommendations by Sanjana

Different Take on Topical Issues: She advocates presenting a different take or opinion on in-trend topics. This does not simply mean opposing the mainstream view; it means delving deeper and finding new perspectives of commenting on the issue. Read her article on cred to get a glimpse of this technique in action.

Using Notion as a Note-taking Tool: Notion is one of the best tools that helps you keep all your notes in one place. Making notes as you read online and extensively referring to them is a great way to improve your writing.

The “WHY” technique for structuring: This technique says that to be an influential writer, always ask “why” with every argument you make. And keep repeating this iterative process until you reach a statement this is factual or already implied to the audience.

Pitching an Article: While pitching an article to an editorial team, it’s essential to do your due diligence beforehand. Be prepared with answers to questions like why this should be a topic for an article, the gap in the market that this piece addresses, and why you are best placed to write this article.

Writing for Audience v. Writing for Yourself: Every writer faces this dichotomy whenever they set out to write about something. Sanjana recommends striking a balance between the two; keep in mind what the audience expects while retaining your own unique style of writing.

Radical Uncertainty by Mervyn King and Sir John Kay

Ibid

Ibid

Ibid

Ibid