What is Factor Investing?

Plus Insights on Factor Investing in India by Anish Teli & Rajan Raju

Let’s start with the very obvious question that might be bothering you. What exactly are factors? In Investing, a Factor is any characteristic that helps explain the long-term risk and return performance of an asset.

Higher Profit Margin —> Higher Stock Returns (maybe?)

Lower Volatility —> Higher Stock Returns (possibly?)

Faster Sales Growth —> Higher Stock Returns (perhaps?)

Profit Margin, Volatility, and Sales Growth are examples of factors. The challenge is to find those factors that are theoretically sound as well as actually hold in financial markets.

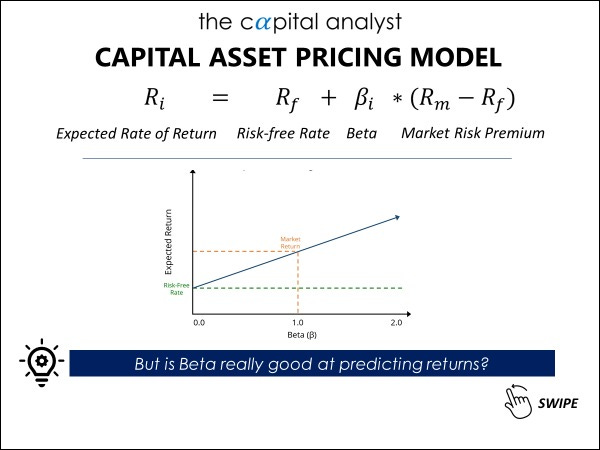

BETA: The Original Factor

Beta is a measure of volatility or systematic risk of a stock compared to the market as a whole. Under Capital Asset Pricing Model (CAPM), Beta is supposed to represent the additional risk a stock adds to a well-diversified portfolio. Thus, a higher beta would mean higher volatility and thus higher expected return.

β is calculated as the regression coefficient of the individual stock’s returns against those of the market as a whole (represented by a Market Index like Nifty 50).

Betting Against Beta

Short High Beta Stocks, Long Low Beta Stocks!

SIZE & VALUE: The Fama-French Model

Size refers to the market capitalization i.e. how small or big the firm is. Value refers to the Book to Value multiple (inverse of P/B) which is an indicator of how cheap or expensive is the company valuation.

Eugene Fama and Kenneth French expanded on the CAPM Model by including Size and Value factors as they observed small cap stocks regularly outperforming large cap stocks and cheaply valued stocks outperforming highly valued stocks.

The Magic of Momentum

Momentum factor refers to the tendency of winning stocks to continue performing well in the near term. Momentum is categorized as a “persistence” factor i.e., it tends to benefit from continued trends in markets.

In 1993, Narasimhan Jegadeesh and Sheridan Titman showed that this strategy generated significant positive returns over 3 to 12-month holding periods. Some attribute this excess return to compensation for bearing high risk; others believe it to be an outcome of under or over-reaction by market participants.

Short Low Momentum, Long High Momentum Stocks

Measuring Momentum1

Absolute Return: Local 6/9/12 month total returns, after excluding the most recent month. (We omit the most recent month to allow for short-term reversal effects).

Risk-Adjusted Return: Sharpe Ratio based on local total 12-month returns, after excluding the most recent month. Annualized volatility is calculated for the same.

Relative Return: The ratio of the current local price to the highest local price over the previous 52 weeks, excluding the most recent month.

High Returns from Low Volatility

Low volatility strategies target securities that show less price volatility than the broader market. They fall less significantly in down markets and participate in a meaningful portion of up-market.

One behavioral finance concept that helps explain this phenomenon is theory of “lottery preferences”. There is a tendency among investors to overpay for small chances of earning large gains , which means they prefer high volatility stocks and cause them to be overpriced.

Short High Volatility Stocks, Long Low Volatility Stocks

Quantifying QUALITY

There is NO consensus definition for quality. Broadly speaking, it means investing in companies with durable business models and sustainable competitive advantages.

Nobel laureates Eugene Fama and Kenneth French recently revised their signature 3-factor model (market beta, size, value) to add two quality-related factors, profitability and investment. Quality is considered “defensive” as it has usually outperformed during tough economic times.

Short Low Quality Stocks, Long High Quality Stocks

How have these factors performed?

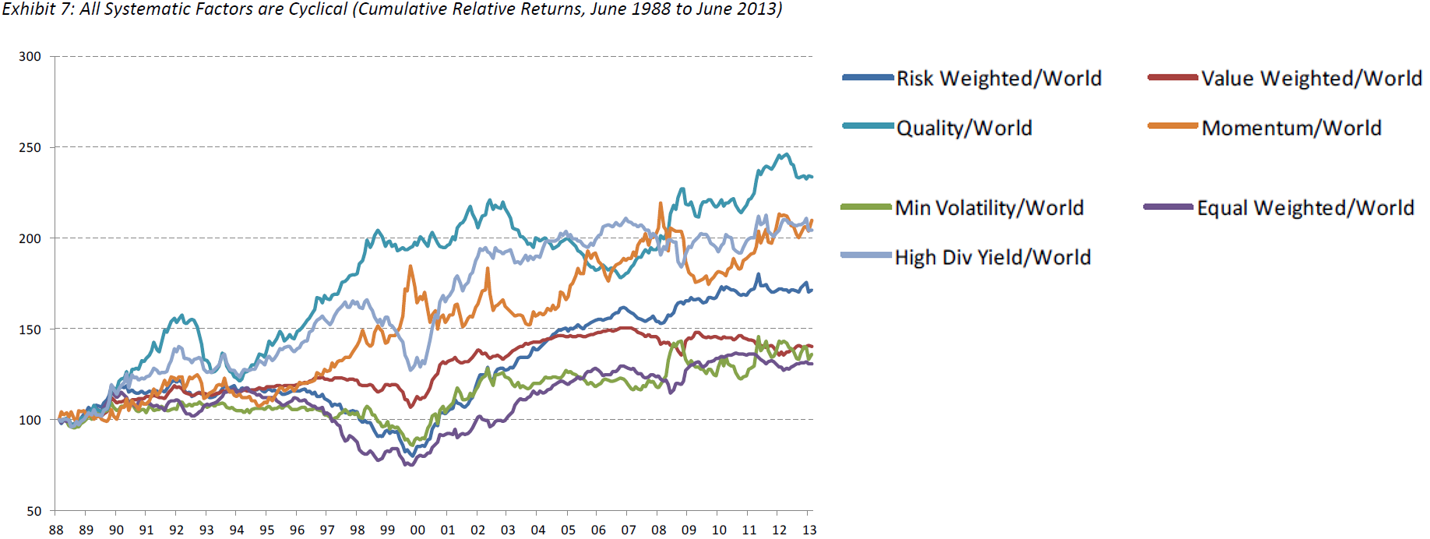

Cyclicality of Factors

While factor indexes have exhibited excess risk-adjusted returns over long time periods, over short horizons factors exhibit significant cyclicality, including periods of underperformance.

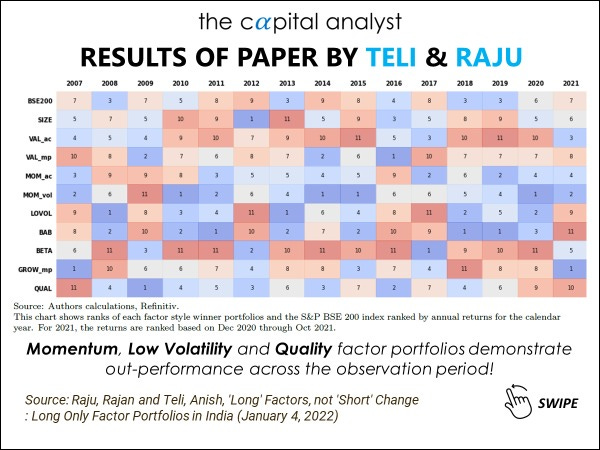

Paper by Anish Teli & Rajan Raju

Anish Teli is Managing Partner at QED Capital, a quantitative investment management firm. Rajan Raju is a Director at Invespar Pte Ltd. Their paper titled, “'Long' Factors, not 'Short' Change : Long Only Factor Portfolios in India”2 aims to find empirical evidence to check which long-only factor portolfios outperform the market in India.

Some of the questions they answer in the paper:

Do long-only factor strategies outperform the broader market?

How much factor/market exposure do these strategies have?

What is the turnover experienced?

Do such strategies persist over time?

What is their size/sectoral composition?

Do they survive in real-world implementations?

They measure the various factors as follows.

And this is how these factor portfolios performed against BSE200.

However, no one particular factor has performed better than all other factors all the time. (Hint: Cyclicality)

Do read the original paper for more in-depth insights. I will be soon dropping a podcast episode with Anish and an IIM Calcutta professor. Subscribe to my channel and join the mailing list below to get notified when it drops!